- Joined

- Jul 3, 2006

- Messages

- 2,739

- Reaction score

- 848

Probably most of you have too much self respect to be familiar with the T.V. show Survivor. It's a U.S. game show where they stick a bunch of people in tropical location and (among other things) starve them for 39 days. About three weeks in, they usually do this thing called the Survivor Auction. They give each of the contestants something like $500 and offer up a limited number of food and/or luxury items to bid on. Video here, if you're curious.

What ends up happening is that you see people paying $400 for a cheeseburger and fries, or sometimes $350 for a can of Pringles (or whoever the sponsor is that season). The contestants, who've existed for 3 weeks on a below subsistence diet, are pantingly eager to shell out crazy dollars for some marginally edible snack food. When the prize is delivered into their possession, they snarf it up like a starving dog and make orgasm noises while they do it. Advertisers love it.

All of these contestants are regular U.S. citizens. If you came up to them in their regular life and offered to sell them a can of Pringles for $350 they would no doubt laugh at you. But in the context of the Survivor auction it made sense. There were only a limited number of items to bit on, and it did them no good to just hold on to the cash.

It occurred to me that this is a tidy illustration of something going on in the stock market that I think will probably affect us all to a greater or lesser degree. Bear with me.

Background

The 401(K) plan is something most U.S. citizens are familiar with. It offers workers the option of contributing a portion of their pre-tax income to a personal retirement plan. The worker saves on their current year's tax bill because, as far as the I.R.S. is concerned, the money sent to a 401(K) plan doesn't exist. The worker benefits by having that money grow tax free until they retire. The government benefits because in 40 years or so they get to tax whatever amount the money grew to. Companies benefit because, if they offer 401(k) plans, they don't have to fund pension plans.

401(k) plans didn't exist until 1980. They caught on in a big way around 1986 or so. These days they've almost completely replaced traditional pension plans.

All of that is fine, but it's crossed my mind that there may be a hidden time bomb in the 401(k) system. Virtually all 401(k) plans invest in the stock market, either through the purchase of individual stocks or through shares in mutual funds.

My actual point:

This resulted in more money being in the stock market. Eventually it was a LOT more money--half of America was using a couple hundred bucks out of every paycheck to buy stock. The thing is, there weren't any more companies available to buy shares of. Also, the companies people were bidding on weren't magically worth more just because people were willing to pay more for them. So, just like the Survivor auction where the guy is willing to pay $400 for a cheeseburger because he's got to buy something, starting about 1986 you saw prices for stocks start rising to price levels that would previously have been considered crazy.

In the stock market, 'crazy price level' is sort of a tough term to define. Company prices rise and fall according to news reports, data, quarterly reports, outright lies, and luck. It's hard to sort through all that and get a truly objective number for what a particular stock is worth at a particular time. But there is one number that I think serves about as well as any (which isn't saying much) as a measure of a company's worth. It's a thing called the price to earnings (P/E) ratio.

Price to Earnings (P/E) is the number you get when you divide the price of a single share of stock by the amount of money that share earned over the last 12 months. So, like, as of about 5 minutes ago the price of Apple computer was $354.54 per share. Each share earned $17.92 over the last 12 months. $354.54 / 17.92 = a P/E ratio of 19.78.

Apple's current P/E is actually not too bad. Historically, a good P/E ratio was something in the 12 to 15 range. During the height of the dot-com boom, you often saw P/E ratios that were in the 50s. Frequently, the P/E ratios of dot-coms were effectively infinite--because the company being sold for $400/share (or whatever) HAD no earnings, you had to divide that $400 by 0. You do the math.

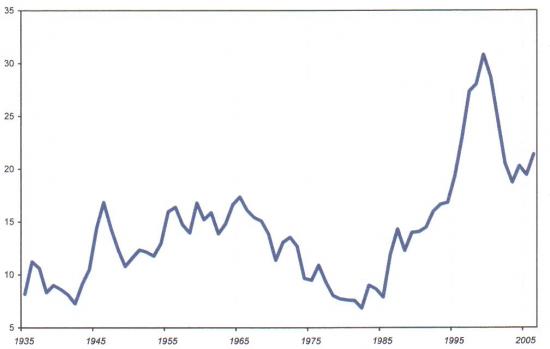

Here's a chart of the P/E ratios over time. Note that this is the P/E ratio of the DOW. The DOW is an index of companies that usually have at least some sort of actual value (as opposed to dot-coms/IPOs). I couldn't find a chart of the market as a whole, but I'm pretty sure it would be a lot worse.

Anyway, this I'm a little worried about. Some of it is just normal boom/bust oscillation. But you see the way the P/E ratios shot up like a rocket around 1986? That was when all the 401(k) money started flooding into the market. Conceivably this is a coincidence, but I have my doubts. Since about 1986, people have been paying prices for stocks that are WAY out of line with historical norms. In some ways, this seemed great. If you had significant stock holdings in 1980 and died last year, it was great. People were, essentially, beating down your door to pay $400 for a cheeseburger you bought in 1980 for $2.

Here's the problem, though. Most people retire around age 65 and, consequently, start withdrawing money from their 401(k) plan. By law, everyone has to start withdrawing at age 70-and-a-half. In 2010, the baby boomers start turning 65. Most of them will start taking their money out of the market soon, if they haven't already. By 2015, all the boomers will effectively be required by law to start selling stock.

In the same way that that vast inrush of cash boosted prices in 1986, I expect that the coming vast outflow of cash will drive prices down.

My thinking is that this will suck in a lot of ways. I don't see that much can be done about it at a national level. On a personal level, I'm thinking of either going short in a big way or maybe looking into real estate.

Any thoughts/suggestions/rebuttals?

What ends up happening is that you see people paying $400 for a cheeseburger and fries, or sometimes $350 for a can of Pringles (or whoever the sponsor is that season). The contestants, who've existed for 3 weeks on a below subsistence diet, are pantingly eager to shell out crazy dollars for some marginally edible snack food. When the prize is delivered into their possession, they snarf it up like a starving dog and make orgasm noises while they do it. Advertisers love it.

All of these contestants are regular U.S. citizens. If you came up to them in their regular life and offered to sell them a can of Pringles for $350 they would no doubt laugh at you. But in the context of the Survivor auction it made sense. There were only a limited number of items to bit on, and it did them no good to just hold on to the cash.

It occurred to me that this is a tidy illustration of something going on in the stock market that I think will probably affect us all to a greater or lesser degree. Bear with me.

Background

The 401(K) plan is something most U.S. citizens are familiar with. It offers workers the option of contributing a portion of their pre-tax income to a personal retirement plan. The worker saves on their current year's tax bill because, as far as the I.R.S. is concerned, the money sent to a 401(K) plan doesn't exist. The worker benefits by having that money grow tax free until they retire. The government benefits because in 40 years or so they get to tax whatever amount the money grew to. Companies benefit because, if they offer 401(k) plans, they don't have to fund pension plans.

401(k) plans didn't exist until 1980. They caught on in a big way around 1986 or so. These days they've almost completely replaced traditional pension plans.

All of that is fine, but it's crossed my mind that there may be a hidden time bomb in the 401(k) system. Virtually all 401(k) plans invest in the stock market, either through the purchase of individual stocks or through shares in mutual funds.

My actual point:

This resulted in more money being in the stock market. Eventually it was a LOT more money--half of America was using a couple hundred bucks out of every paycheck to buy stock. The thing is, there weren't any more companies available to buy shares of. Also, the companies people were bidding on weren't magically worth more just because people were willing to pay more for them. So, just like the Survivor auction where the guy is willing to pay $400 for a cheeseburger because he's got to buy something, starting about 1986 you saw prices for stocks start rising to price levels that would previously have been considered crazy.

In the stock market, 'crazy price level' is sort of a tough term to define. Company prices rise and fall according to news reports, data, quarterly reports, outright lies, and luck. It's hard to sort through all that and get a truly objective number for what a particular stock is worth at a particular time. But there is one number that I think serves about as well as any (which isn't saying much) as a measure of a company's worth. It's a thing called the price to earnings (P/E) ratio.

Price to Earnings (P/E) is the number you get when you divide the price of a single share of stock by the amount of money that share earned over the last 12 months. So, like, as of about 5 minutes ago the price of Apple computer was $354.54 per share. Each share earned $17.92 over the last 12 months. $354.54 / 17.92 = a P/E ratio of 19.78.

Apple's current P/E is actually not too bad. Historically, a good P/E ratio was something in the 12 to 15 range. During the height of the dot-com boom, you often saw P/E ratios that were in the 50s. Frequently, the P/E ratios of dot-coms were effectively infinite--because the company being sold for $400/share (or whatever) HAD no earnings, you had to divide that $400 by 0. You do the math.

Here's a chart of the P/E ratios over time. Note that this is the P/E ratio of the DOW. The DOW is an index of companies that usually have at least some sort of actual value (as opposed to dot-coms/IPOs). I couldn't find a chart of the market as a whole, but I'm pretty sure it would be a lot worse.

Anyway, this I'm a little worried about. Some of it is just normal boom/bust oscillation. But you see the way the P/E ratios shot up like a rocket around 1986? That was when all the 401(k) money started flooding into the market. Conceivably this is a coincidence, but I have my doubts. Since about 1986, people have been paying prices for stocks that are WAY out of line with historical norms. In some ways, this seemed great. If you had significant stock holdings in 1980 and died last year, it was great. People were, essentially, beating down your door to pay $400 for a cheeseburger you bought in 1980 for $2.

Here's the problem, though. Most people retire around age 65 and, consequently, start withdrawing money from their 401(k) plan. By law, everyone has to start withdrawing at age 70-and-a-half. In 2010, the baby boomers start turning 65. Most of them will start taking their money out of the market soon, if they haven't already. By 2015, all the boomers will effectively be required by law to start selling stock.

In the same way that that vast inrush of cash boosted prices in 1986, I expect that the coming vast outflow of cash will drive prices down.

My thinking is that this will suck in a lot of ways. I don't see that much can be done about it at a national level. On a personal level, I'm thinking of either going short in a big way or maybe looking into real estate.

Any thoughts/suggestions/rebuttals?